34+ qualifying home mortgage interest

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Get The Answers You Need Here.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

The limit is 375000 for a married taxpayer filing a separate.

. You filed an IRS form 1040 and itemized your deductions. Web If you qualify for a mortgage the lender will be able to provide the amount of financing and the potential interest rate you might even be able to lock in the rate. Web Todays national mortgage interest rate trends For today Wednesday March 22 2023 the current average 30-year fixed mortgage interest rate is 694.

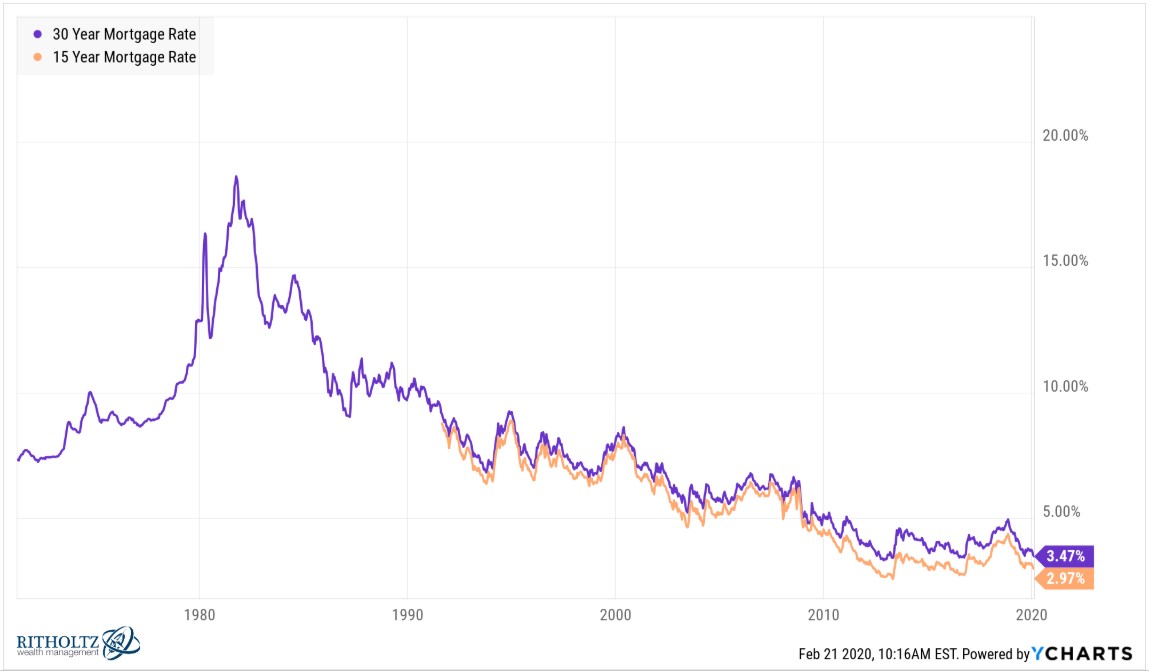

Web How do I go to the Deductible Home Mortgage Interest Worksheet in ProSeries. Web As of March 25 2021 Freddie Mac listed the 15-year fixed-rate mortgage average interest rate as 245 while the average rate for a 30-year fixed-rate loan was. In 2022 the conforming loan limit in most areas in the.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Although its a myth that a. To access the Deductible Home Mortgage Interest Worksheet in ProSeries.

Web Qualified mortgage interest includes payments made toward mortgage insurance points paid on your loan interest paid on the loan of your primary. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Homeowners who bought houses before.

Web Jumbo loans also called nonconforming loans are mortgages that exceed the conforming loan limits. Web To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and. Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements.

The Best Lenders All In 1 Place. Web Conventional Mortgage Qualification Requirements Down payment. You may qualify for a loan amount of 252720 and your total monthly.

Some loans like VA loans and some USDA loans allow zero down. Ad Top Home Loans. Ad Dedicated to helping retirees maintain their financial well-being.

See if you qualify. No SNN Needed to Check Rates. Web Also beginning in 2018 taxpayers may only deduct interest on 750000 of qualified residence loans.

Ad Low Fixed Mortgage Refinance Rates Updated Daily. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web A home mortgage interest deduction is an itemized deduction that allows homeowners to deduct any interest on loans that are used to build improve or.

Lock Your Rate Today. Over the life of the. Web Such deductions may include qualifying home mortgage interest charitable contributions state and local taxes up to 10000 and medical expenses in excess of.

This is down from the week prior which was 658 and up significantly. Ad Compare the Best Mortgage Lenders for March 2023. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Compare the Best Mortgage Lenders for March 2023. Youll be able to. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Most conventional mortgages require a 5 down payment although some borrowers may. Web 18 hours agoAs of March 15 the average interest rate for a 30-year fixed VA purchase loan is 627. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Compare Lowest Mortgage Refinance Rates Today For 2023. Compare a Reverse Mortgage with Traditional Home Equity Loans. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Lock Your Rate Today. Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163 h 3 E and formerly reported on lines 10 and 16 as deductible mortgage. Get Instantly Matched With Your Ideal Mortgage Lender.

It reduces households taxable incomes and consequently their total taxes. Web 15 hours agoA 15-year fixed-rate mortgage refinance of 300000 with todays interest rate of 634 will cost 2587 per month in principal and interest. Web Most home loans require at least 3 of the price of the home as a down payment.

Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193.

Lot 34 Chinquapin Ln Morgan Hill Ca 95037 Mls Ml81917807 Zillow

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Maximum Mortgage Tax Deduction Benefit Depends On Income

Stevesellsdfw S Blog Don T Just Read Write Something

Maximum Mortgage Tax Deduction Benefit Depends On Income

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

What Is Mortgage

Edelweiss Housing Finance Home Loan Interest Rate Starting 10 25 P A

Should You Pay Off Your Mortgage Early With Rates So Low

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

How Lenders Calculate Mortgage Interest Rates Mortgagehippo

Blue Ridge Realty High Country Real Estate Listings Summer 2019 By Blue Ridge Realty Investments Issuu

Gic Housing Finance Interest Rates 8 75 P A

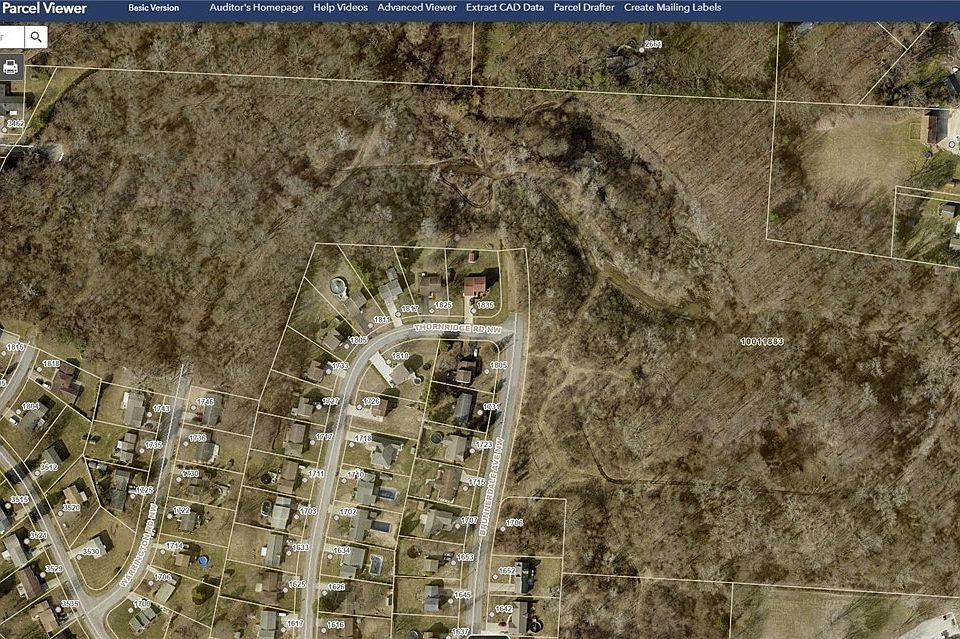

Brunnerdale Ave Nw Massillon Oh 44646 Mls 4438741 Zillow

Mortgage Preapproval Vs Prequalification How To Get Preapproved

Graphs Of 300 Game Winners

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu